Want to Increase Your Critical Illness Sales?

You have probably seen all the stats and projections about how many of your current clients and prospects are going to be impacted in the future by a critical illness. Yet recent stats from LIMRA suggest that sales are on the decline.

Critical Illness (CI), often referred to as a "Living Benefit" (meaning we would use it while we're still alive), is the creation of South African heart surgeon Marius Barnard, brother of heart transplant pioneer Christian Barnard. CI was created after witnessing the hardships that directly follow a major illness such as a heart transplant.

As a living benefit, you would think it would be easier to sell as it's not as selfless a purchase (as say life insurance). You get tax-free cash to support your family if you can't due to a covered critical illness. Having personally witnessed this, I can tell you it can make a person infinitely more comfortable in their hardest moment. However, I have also seen how strict insurance companies are with their definitions so make sure you understand the product you are selling. As with almost any insurance, we hope we don't have to use it. We buy it and sell it because we know that in the event of a critical illness, it's designed to protect our long-term goals and fund a potential liability (the loss of our human capital) at a lower cost.

As you can see in this infographic approximately 1/4 people will experience a criticall illness in their life! So why are sales on the decline?

CI is a relatively new product (introduced to Canada in 1993) compared to Life Insurance that has been here for well over 100 years so it's often thought of as a cross-sell secondary to Life Insurance. Some of you reading this may focus on this market segment and sell life as a secondary product. However, in either case, it begs the question...

Are you cross-selling insurance effectively?

Cross-selling finds products that satisfy complementary needs that are unfulfilled by the original item. For example, a dog leash sale could be cross-sold to a customer purchasing a collar. Okay, I really didn't need to be that abstract. It's selling CI after you sell Life Insurance (or vice-versa).

HubSpot gives these tips to create more success when cross-selling. However, most of these points take care of themselves in the case of Living Benefits complimenting Life Insurance. So is there another factor preventing advisors from selling more CI?

Many advisors I speak with express a focus around holistic planning trying to include Life, CI and DI into every financial plan, but agree it takes the right kind of client and can be difficult trying to communicate all products at once. Add in other client relations (like their CA, investment "guy" and the bank's) and you have a literal tug of war inside your client's head around what to spend their dollars on.

One of my favorite critical illness conversation starters I have heard goes like this:

Advisor: So John, if you had a machine in your garage that printed money, would you get insurance just in case it broke down?

Client/John: Well yes, of course! I would be silly not to ...

Advisor: Fantastic! John, guess what? You are that machine and I want to share this presentation to show you some options on how you can protect yourself in the event of a critical illness and get all your money back if you don't.

Okay, maybe it's a bit of a pitch, but the analogy rings true for me. I'm sure I could think of a few variations that could soften the message if it's too Ned for you.

Have you ever heard that Woody Allen quote? "80 percent of success is showing up.” Well, the same is true when selling living benefits or anything for that matter. You have to show your customers their options if you want to sell them something.

So, if you are honest with yourself - Do you have a system in place to remind you to cross-sell CI and add more revenue and value to your book of business?

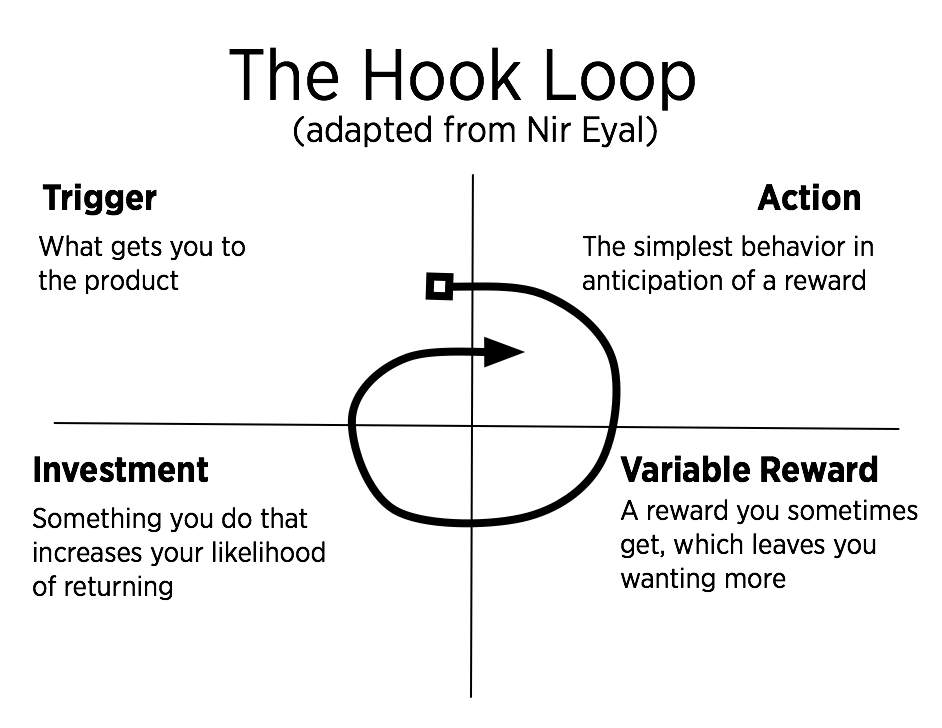

To create a new behavior we need:

- A Trigger

- An Action

- A Reward

- Investment

- I Have Coverage At Work

- What If I Offend My Client And Appear To Be Asking For Too Much?

- Confusion

- I'll Have To Ask My...

- I'm Super Healthy

- It Costs Too Much

The sale of a Life Insurance Policy

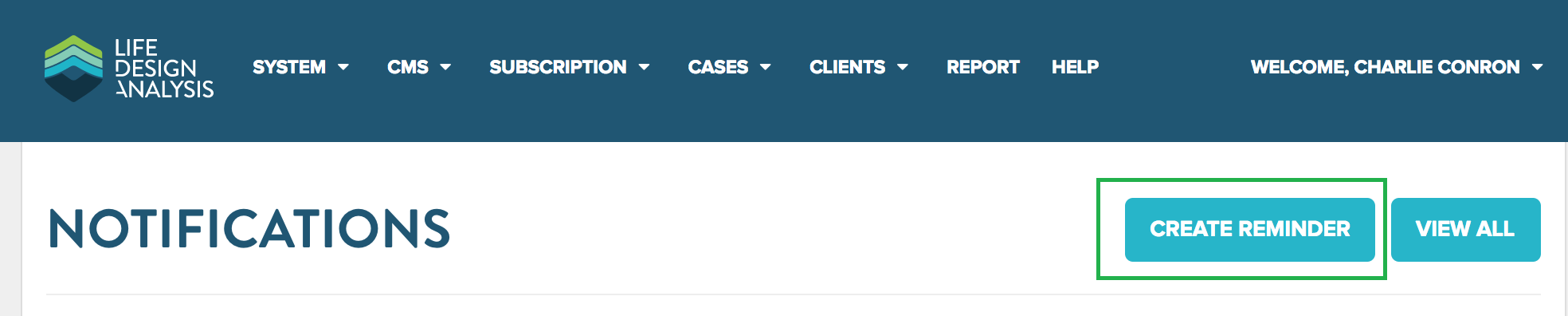

Create a reminder in LDA asking for the cross-sell

Helping your clients

The commission

When you sell a life policy, set a reminder for three months in the future in your LDA notifications.

This will not only remind you to follow up with the client and see if all their needs have been met, but it will also remind you to cross-sell. Research suggests three months is the ideal time to ask for referrals and cross-selling is not all that different.

One tip I think can dramatically improve your success is to plant the idea early. Tell your clients as part of your sales process you will be following up to make sure they had a good experience and will provide some information on living benefits that would complement their life insurance purchase. When you follow up on the service, you can deliver on your promise. If your not sure what kind of coverage they had, ask if they would object to a review.

Consider this presentation that gives them options for affordable term coverage compared to long term coverage that can return their premium if they don't use it. You might even include a report note like a spit dollar concept if they are a key person in a business.

Giving options lets the client make an informed decision and know current pricing. Even if they don't purchase, at least you have a documented case showing them you asked. Remember to cater your comparison based on their goals, timeline and cash flow. If you know they can't afford a Term 75 with ROPD, compare a Term 10 to a Term 20 or 25 to match their mortgage or greatest liability length (their need).

To create your own LDA CI report, Sign Up Free Today to drive more CI sales!

What are the common objections to Critical Illness?

Okay, so in a perfect world, all our clients say, "Yes! Can I buy more?"

So let's focus on some of the common objections and how we can tackle them.

Let's get this out of the way first. Yes, you might have coverage at work but there is a good chance it's not adequate. There is a good chance it does not cover what you think it does. There is a 99% chance it is not portable and this is really the biggest issue (in my opinion). Many people work for a company for 20 years and, due to factors like downsizing, lose their benefits in a flash. Unfortunately, because living benefits are so commonly used they get extremely expensive to buy particularly at an increased age and even harder to underwrite. I recommend illustrating a cost of waiting analysis to illustrate the risky assumption they could buy CI if they left or lost their job.

Honestly, it's okay. It's your job to ask the hard questions. Ask those who have been in the Life Insurance industry for a long time. They can tell you about when they deliver a claim cheque, it's more like this:

This is quite common and relatively easy to remedy. Sometimes people are confused about how the product works and/or how it's priced (if and how that changes over time) and what the benefit is (guaranteed vs. non-guaranteed). A perfect way to handle this is with a custom concept page and visual comparison of options. This can help get your client over the hurdle.

Use our custom callouts to add more detail to reports. Reports with visuals are more persuasive than those without and show, as their advisor, you have the best tools on the market to deliver the best service possible.

This can be a spouse, a parent or a member of their council (Accountant, Lawyer, etc.) This is a good sign, it means they respect what you are proposing but want to make sure it's on board with their overall financial plan. In this situation, it's more important than ever to have a tight presentation. Think about using a a shared case that has a "Reason Why" letter included. Add a custom explanation indicating why you think insurance is a sound part of your client's portfolio and back it up with the data. You can require guests to enter their information to view the case so you will know when and how long the respective parties have looked at the report. Get the 3rd party involved if you can so you can communicate the benefits directly to them as well.

Great! This is the best time to buy. It's never going to be more affordable. Remember...

Cost is always an issue, moreover cashflow. Most clients probably have the income to support the purchase of a CI policy. However, it's more how they prioritize this expense in relation to others in their life. People are always picking on coffee saying that for the same price you spend on coffee in a week, you could have CI. Have both! Ask my wife - You don't want to see some people with no coffee! There are plenty of ways you can help your clients free up cash flow. Some ideas might include reducing their life insurance premium by having them paying annually or bundling a CI with their life policy for a multi-policy discount. Sometimes, as the saying goes, "You can't get blood from a stone," and funds will be limited. This is a great opportunity to present a layered plan that uses a mix of different term lengths designed to reduce in coverage as time goes on and be budget-friendly.

Conclusion

The more presentations you make on Critical Illness products to your clients, the better chances you have to actually sell it.

Make a compelling presentation with options that help your client pick the right solution.

Have a process and stick to it. Plant the idea early and make it part of the client onboarding that you will provide information on complementary products.

Want more ideas on how to grow your practice? book a training session with Jon or Nik from our support staff to see how Life Design Analysis can help your practice.

Want to more easily communicate insurance options with your clients Sign Up Free Today!