How The New Wave Of Tech Is Making Old School Sales Obsolete

The status quo is changing. Advisors everywhere are being force-fed discussions of "disruption." Does disruption mean advisors have to fight back? Evolve? Do they even have a choice? In my presentation originally done for InsurtechQC 2018

I explore influences shaping the new landscape of financial services. We'll look at what transformation looks like vs. disruption and what advisors can do to meet the evolving expectations of the new customer.Disruption vs. Evolution

If I made a drinking game for this article, many would not make it to the bottom of the page. Disruption is such a buzz word today to which the collective media are certainly guilty of sensationalizing it. We hear this term frequently and we often might see it posted with an image similar to this on a social media platform such as LinkedIn.

Would you consider these companies to be disruptive or evolutionary?

If we look at Apple, sure they let people buy individual MP3s that may have killed the CD and album sales, but we're seeing another evolution in streaming displacing even the mighty MP3. So was this "disruption" or just simply evolutionary?

Do you beleive in disruption?

Technology on its own is not the real disruptor…

Losing focus on the customer experience is the biggest risk to any business.

However, technology is the means to raise the bar and change the customer experience and in this way it can be disruptive.

Let's look at some examples

How about the most classic example of disruption - The horse and buggy vs. the car. Not only did this kill the buggy industry (which some say could have pivoted on their real skill of leather work) but everyone related to that industry down to the whip maker. Not really a demand for that whip in my Model T.

Now we see Tesla disrupting/evolving the automotive world all over by introducing not only a new customer experience exceeding what they thought possible from the automotive industry today but also redefining how they will power their cars shaking up the energy market. Elon himself thinks as the factory that the Model T and the Gigafactory are the real success, not the car itself.

Remeber technology is not always a physical gadget. In a broader sense, it also includes knowledge of techniques.

How about another very on-the-nose example? How many still use a physical map to get places? I know some will still carry one in the car. Is it as up to date as your GPS? Did the GPS disrupt the paper map or was it an evolution? Has TOM TOM been re-disrupted by the smartphone or was it just another evolution? If you said yes to still using a physical map, can you say that your kids or grandkids can read one?

If I told you 5 years ago department stores would be replaced by bee-hives equipt with drones to deliver your package often the same day we order them, would you believe me?

What could I tell you about the direction of the insurance industry in 5 years that would make you laugh me off stage? Technology has a way of seeming so far-fetched and futuristic but then we blink and cars are driving themselves, insurance policies are underwriting themselves and consumers are doing their own research using the next Facebook and a AI.

Old Way vs. New Way

Cold calling might have once been a staple of the insurance world, but now might get received more like above. I’m not sure I would say the phone has been “disrupted” (we have a saying at LDA that calls close deals). If the phone has not been disrupted, it has certainly evolved and the new way of finding and engaging prospects en-mass just does not work with old-school sales techniques.

In fact, according to LinkedIn data:

So What is Technology?

With technology “disrupting” so many industries, it’s probably worthwhile defining what really is technology?

Or more specifically what is #Fintech and its subset #Insurtech

Would You Consider Pizza Hut A Tech Company?

Would you consider Pizza Hut to be a technology company?

Would you consider your insurance practice or company to be a tech business?

What if I told you 46% of delivery and carry-out orders from Pizza Hut come through digital channels?

That’s 1.2 Billion $ in online sales…

Would you reconsider your answer if you thought Pizza Hut was a tech company or not?

"I think what we're going through is… the 'Uberization' of our customer experience,” Pizza Hut's Chief Digital Officer, Baron Concors, told Business Insider. “A lot of people think Uber really transformed the transportation industry, but I think they've really transformed commerce.”

If you think about the level of control and transparency people have when ordering pizza, they can literally pick their own toppings at their own pace, order from their cell phone and get notifications at every stage of the pizza creation process.

![]()

Now, I want you to think about your clients' experience when buying insurance

Insurance Client Experience Not Found

“85% of people said they would use the Internet in some way to purchase a life insurance policy.”

So I want you to question if you are a tech company or an insurance company/agency/advisor? Can you be both?

Can you marry the two to give the client the best experience possible?

If you can’t, you need to find the partner who can make you because your customer has already evolved and they are changing rapidly due to innovations in the customer experience in other industries.

This “uberization” Barron describes regarding his pizza business has a profound impact on other industries including the insurance industry because it changes the client's expectation of what a transaction should be. Yes, I agree we're talking life insurance not pizza but I think we can all agree that embracing the client experience using technology is the best way to deliver what the modern consumer expects. One way the industry can help is by creating visibility around data to 3rd parties that advisors rely on to help bridge communication.

If we revisit our disruptive companies (Apple, Uber, Amazon, Netflix) they all offered a better experience for the client by letting them transact on their own terms and offering a level of convenience that made it easy to make decisions on the clients' timeline. It largely allows customers to get an education about products based on their own preferences and communication channels.

Here’s what we see: Technology is transforming the sales profession from the way leads are generated to the conversations that happen once the “digital handshake” is made. To a large extent, it’s accelerating connections, shortening sales cycles and bringing a new level of transparency that is unlike anything buyers and sellers have ever experienced. How we react to this as an industry is another story.

Who wants change?

Who wants to change?

Napoleon Hill in his book “Outwitting the Devil” warned us to get into what he calls “hypnotic rhythm," which means doing something over and over until it becomes a habit that becomes the person’s identity and cannot be broken as they do it unconsciously. Sound familiar?

If Uber influenced commerce, you could certainly argue that Amazon led that charge. A lesson to retailers everywhere that if we fail to engage and give transparency and ease of purchase to our customers, we are at risk of evolution or flat out disruption.

It’s not too far-fetched with the recent news that we would see Amazon not only selling insurance but offering its own product. After all, Jeff Bezos has famously been quoted saying:

“Your margin is my opportunity.”

Would Jeff Bezos Like the Margin in the Life Insurance Industry?

According to a recent LendEDU survey of 1,000 Amazon customers:

38% of Millennials said they would trust Amazon to handle their finances just as much as they trust a traditional bank.

So just FYI, we don’t have to be disrupted. The insurance industry is still at the sweet spot where we can embrace technology and make technology our differentiator.

For a sales-focused distribution model, why is the insurance industry having such a difficult time with tech? Just look to the adoption of E-apps which are an obvious improvement but still lack industry adoption.

If were going to change, we need to get outside our comfort zone

We need to adopt new behavior. Like any new behaviour we need a new trigger.

Technology needs to be a bigger part of life insurance if we are going to change the trend of declining sales.

It may not a surprise you that the customer journey has changed. However, of all the “disruptive” companies I listed, there is a consistent trend to make the customer journey more simplistic and give a more catered experience for the consumer.

Advisors and Insurers can no longer ignore process improvements that align the customer insurance journey with other purchases in their world.

Unique Value Proposition

Many advisors might reference their unique value proposition as being able to listen and find the best solution to their clients' unique situations. However, we must also consider when it comes to problem solving people are not always asking their advisors (or even their family) as the first point of contact anymore.

There is a huge increase in personal searches (me, me, me). This is a great opportunity for advisors who embrace digital and can provide information valuable to their customer and accessible on their terms.

Risk

If we want to see a change, we must become technology and we must marry digital with our knowledge of techniques to add convenience, communication and transparency to the customer experience. We must become proactive in our service and deliver support to our clients on their terms. We risk the unknown. We risk change and getting out of our comfort zone and out of our hypnotic rhythm.

Reward

We have a unique opportunity to decide if we want to be Blockbuster or Netflix.

Be there for customers in new ways

Digital Strategies

A website is now table stakes, clients will judge the quality of your service by how professional your website looks. A polished website is no longer a technological advantage. It's a given. But if your website is not remarketing or retargeting, you need to start. Think about affiliate remarketing if you work with a COI, get your tag on their site. This is a new way you can use technology to stay top of mind.

Provide valuable content for your target buyer, be a thought leader and create and share the years of expertise you have built up in the form of content that answers your clients' biggest questions when they turn to Google for the answers to their immediate questions.

Dux-Soup is a powerful tool for LinkedIn that allows you to target your specific audience (physicians, people changing roles, vets) and view their profile generating curiosity and getting your prospects to look back and find all your thought leadership and content marketing. Whatever your audience, a view from your profile can spark interest in the right prospects.

Hunter.io is a powerful tool to gather lots of email addresses from a given domain. Sure cold calling is dead and to some extent so is cold emailing but you can still stay top of mind by using these email addresses in a display ad or Facebook ad campaign and remain top of mind and CASL compliant.

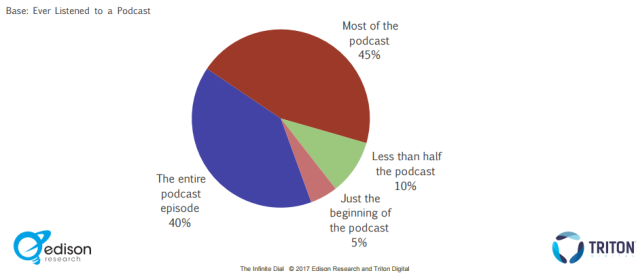

Podcasts or webinars are an excellent way to capture people's attention. A recent stat revealed that most people listen to almost all of a podcast when they start one.

Technology can be used to create a highly-personalized experience and help better communicate our value proposition to more people.

Conclusion

This is a great example of technology in the broad sense of “knowledge of techniques.” This is a gorilla using a stick to gauge the water depth making him better able to do his job - Survival. Not unlike anyone else, if you were walking in the park, you may not think of a stick as technology but when this gorilla uses the stick to gauge the depth of the water it becomes technology.

Advisors are uniquely positioned to combine two forms of tech their human intuition, knowledge of techniques and their ability to harness technology in the more classical sense (LDA, CRM, E-apps).

Tech has changed the speed and scale that business is done. Tech is an enabler that can automate functions previously unthinkable (*cough* self-driving cars) but tech alone is not a disruptor. Technology and attention to the client experience is what makes a sustainable business model.

I remain very bullish on advisors. Without the willingness for change and collaboration (not industry fragmentation) on all distribution levels, it will be hard to stay in the game. There is no question the industry is evolving rapidly at the moment. However, I think how the current distribution model reacts to technology will determine how “disruptive” that evolution will be.

At the very least, incorporate tech because even the gorillas are doing it and you don’t want to lose your next insurance sale to a gorilla.