Market Trends

Welcome to the first edition of Market Trends, presented by Life Design Analysis, a segment dedicated to looking at the market as a whole and providing ongoing research into the evolving landscape of the insurance market. Please keep in mind the data represented applies only to LDA and not necessarily representative of the entire market.

Purpose

The purpose of Market Trends is to look from a high level at what products and companies are trending and look at the different segments, who the market leaders are and how that has progressed over the last three months. I hope to provide regular commentary and see changes as new products are introduced to the market.

Whole Life

Let's start with Whole Life.

March

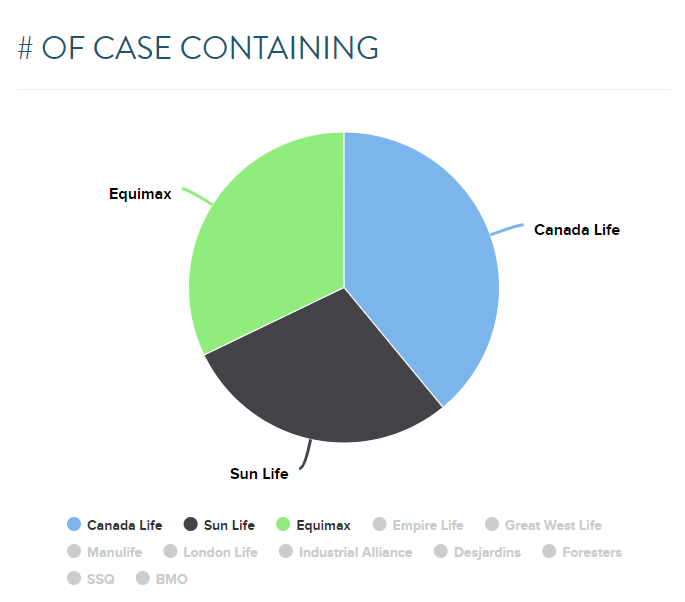

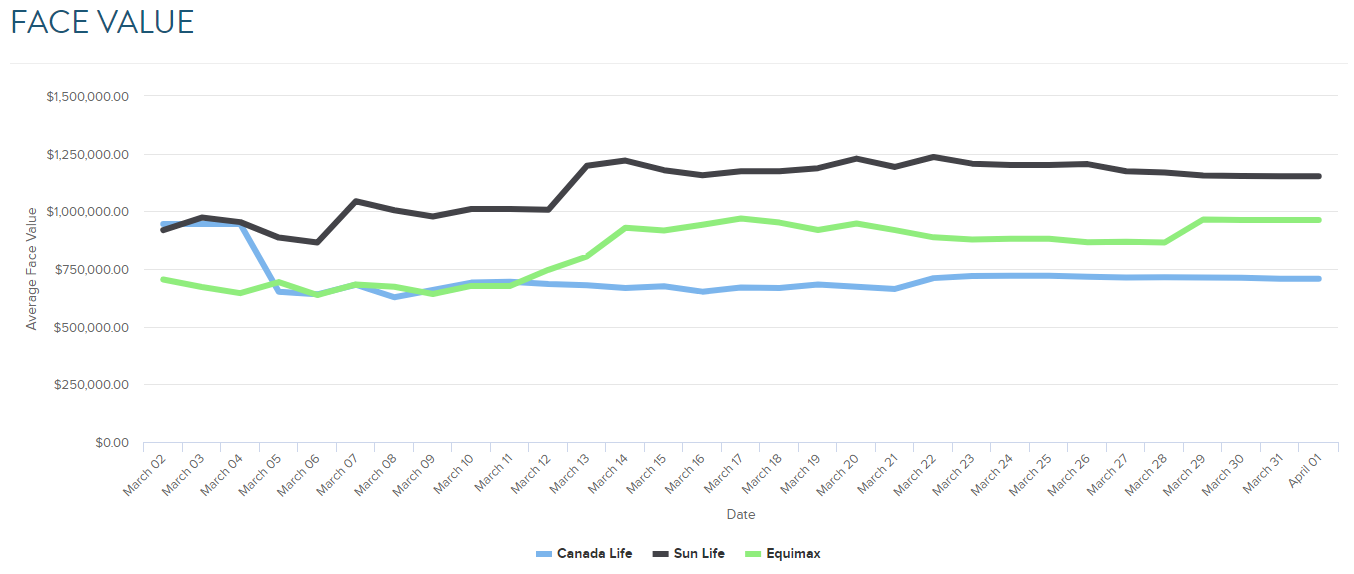

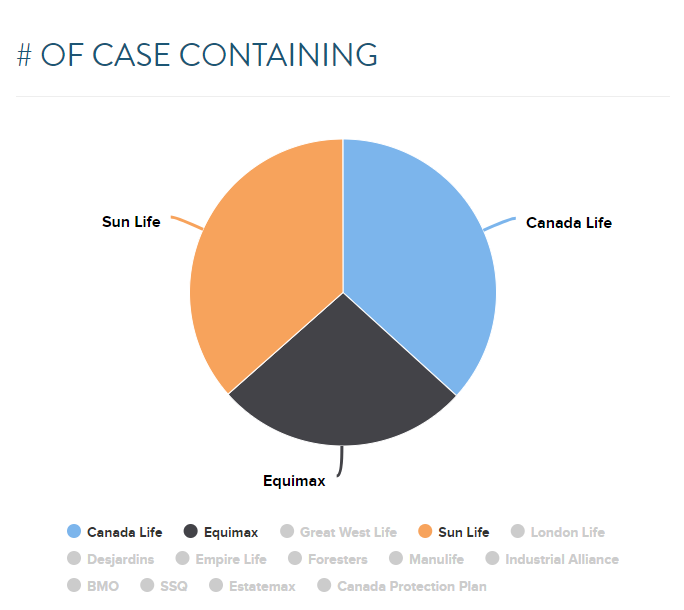

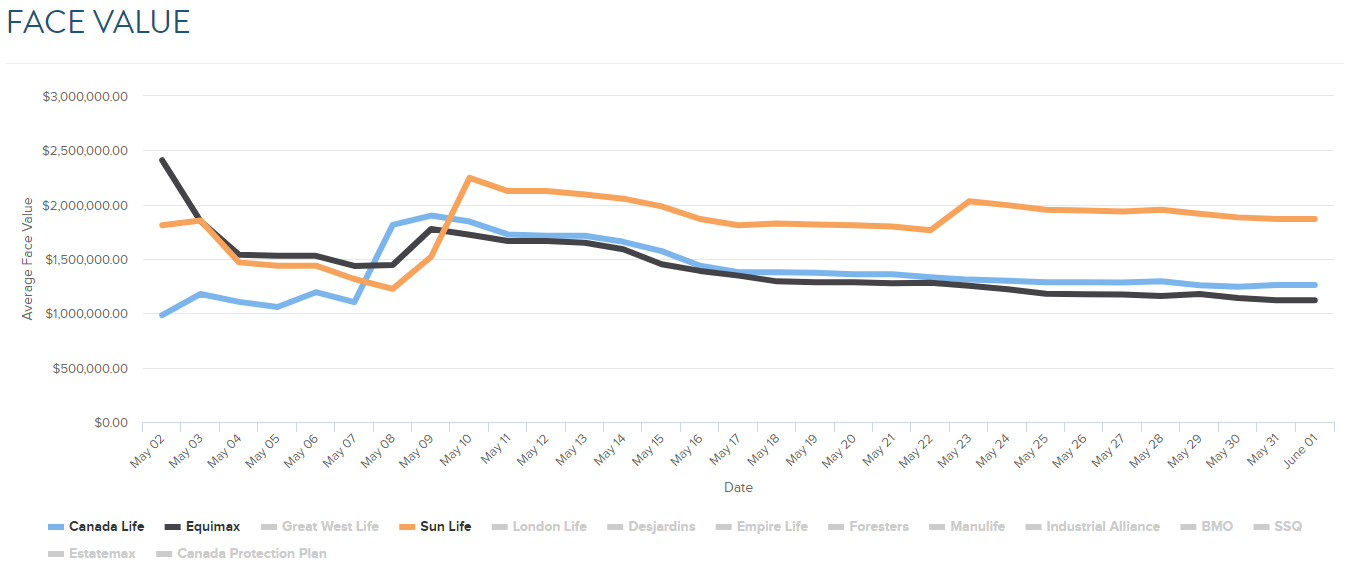

March saw Canada Life take top honours as the most presented Whole Life solution on the LDA platform followed closely by Equitable Life. Rounding out at third was Sun Life.

However, when we look at the average face value of those three carriers over the month, we can clearly see that order flips. Sun Life takes top honours for face value with Equitable Life placing second followed closely by Canada Life.

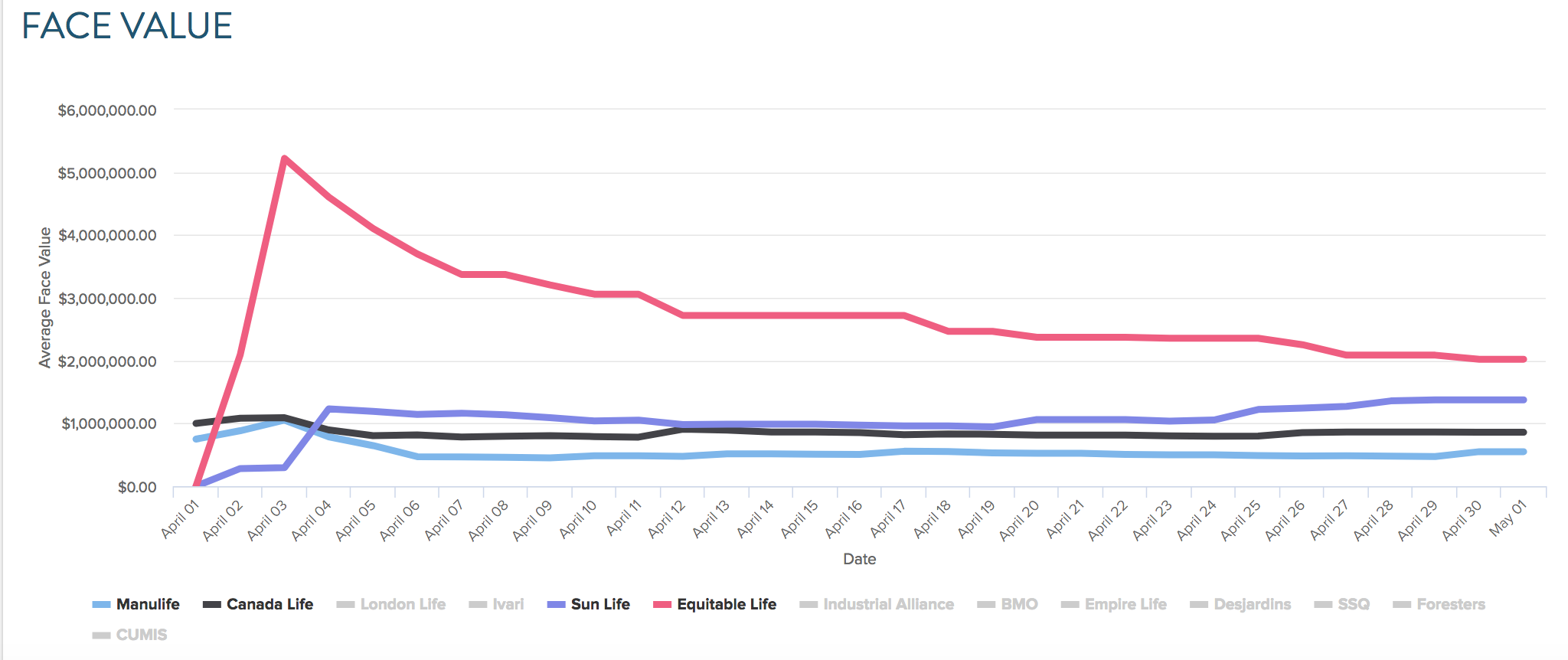

April

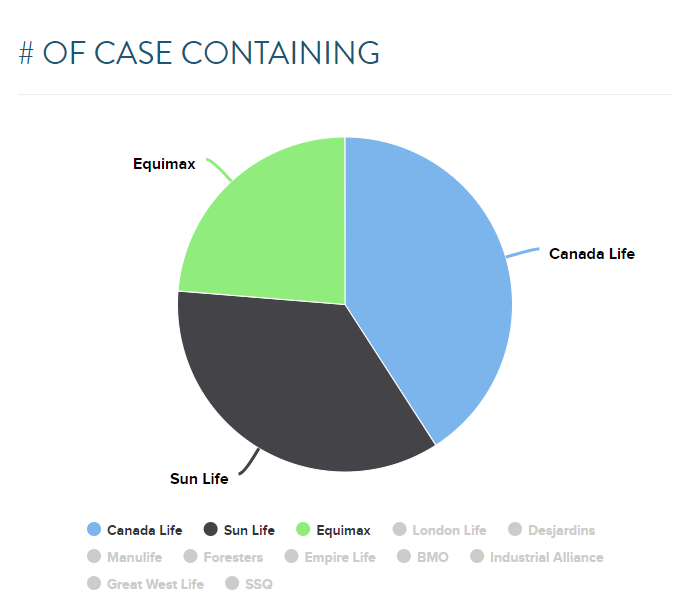

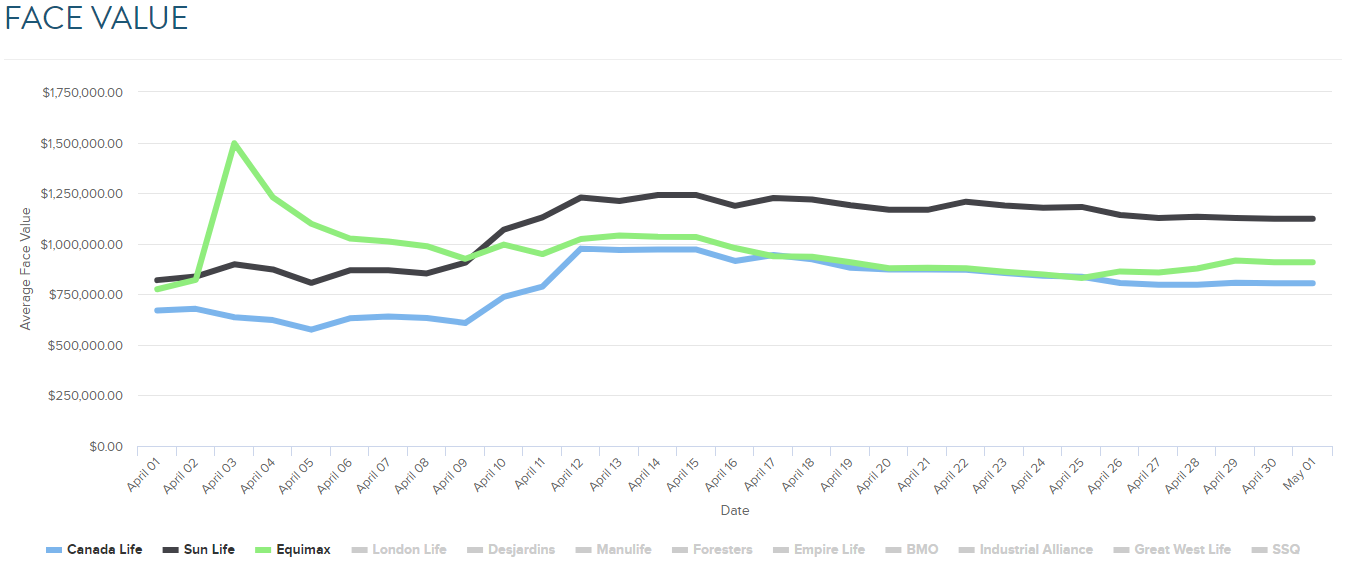

April saw similar numbers with Canada Life taking top honours. However, Sun Life gained momentum to claim the second spot with Equitable Life placing third.

A peek into face value shows Sun Life remaining in the top spot with Equitable Life taking runner-up and Canada Life a close third place.

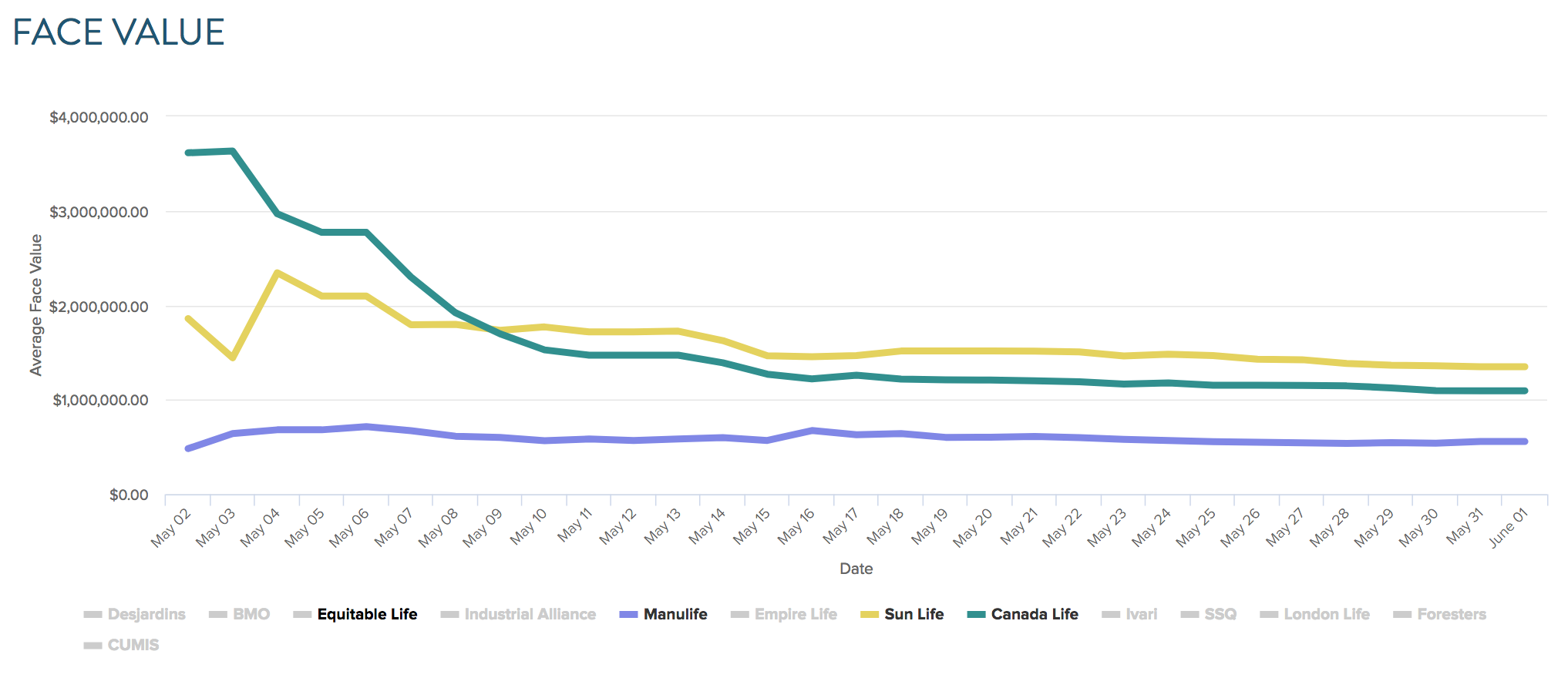

May

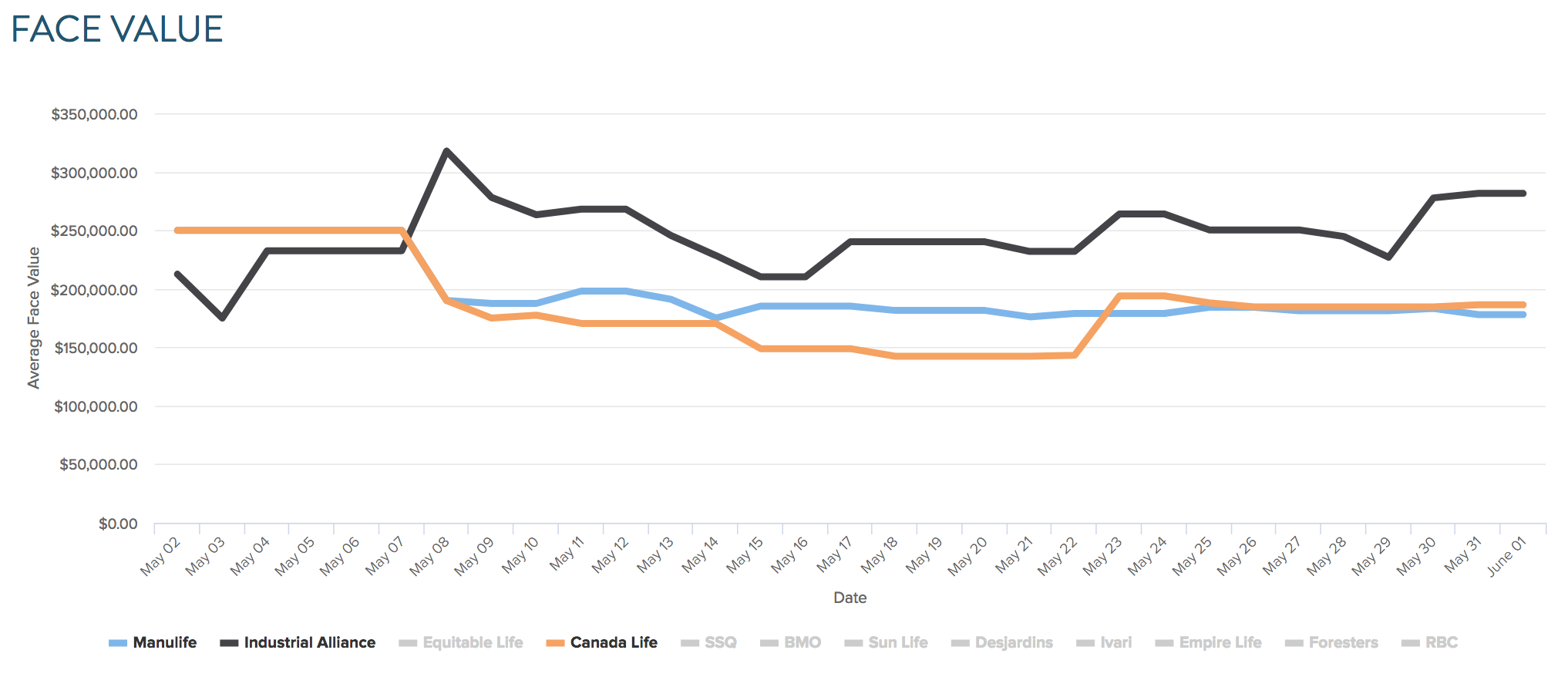

May saw the Sun Life momentum carry forward nearly edging Canada life (only a handful of cases shy), so it will be interesting to see if this trend continues going forward. Canada Life still took the pole position followed by Sun and Equitable.

In terms of face value, the trend has stayed consistent. Sun Life taking the top spot with Canada Life and Equitable in a dead heat.

It will be interesting to see in the coming quarter how the trends continue with Manulife introducing a new participating product and Equitable lowering the dividend of their par fund. We'll keep an eye on how that shapes their market share in the coming months. One other side note, while we will be exploring the top three companies, an honourable mention goes to Empire life who placed fourth place over the quarter in relation to the number of cases presented.

Term

Let's move on to another segment and explore leaders in the term market and see what the analytics tell us

March

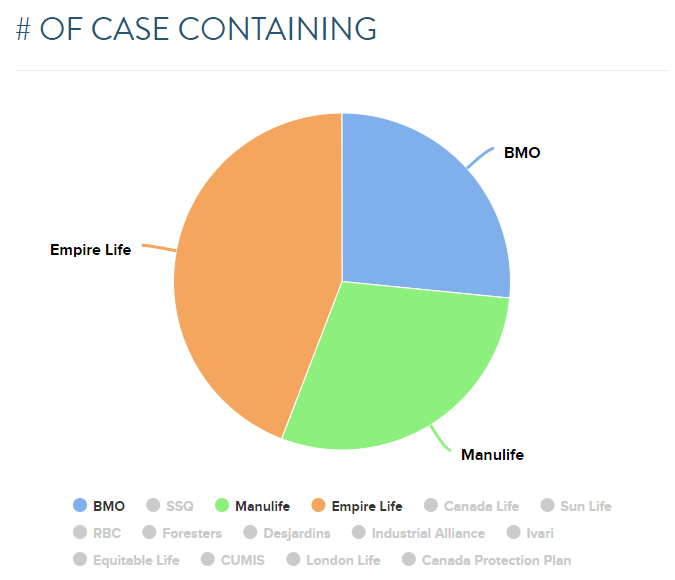

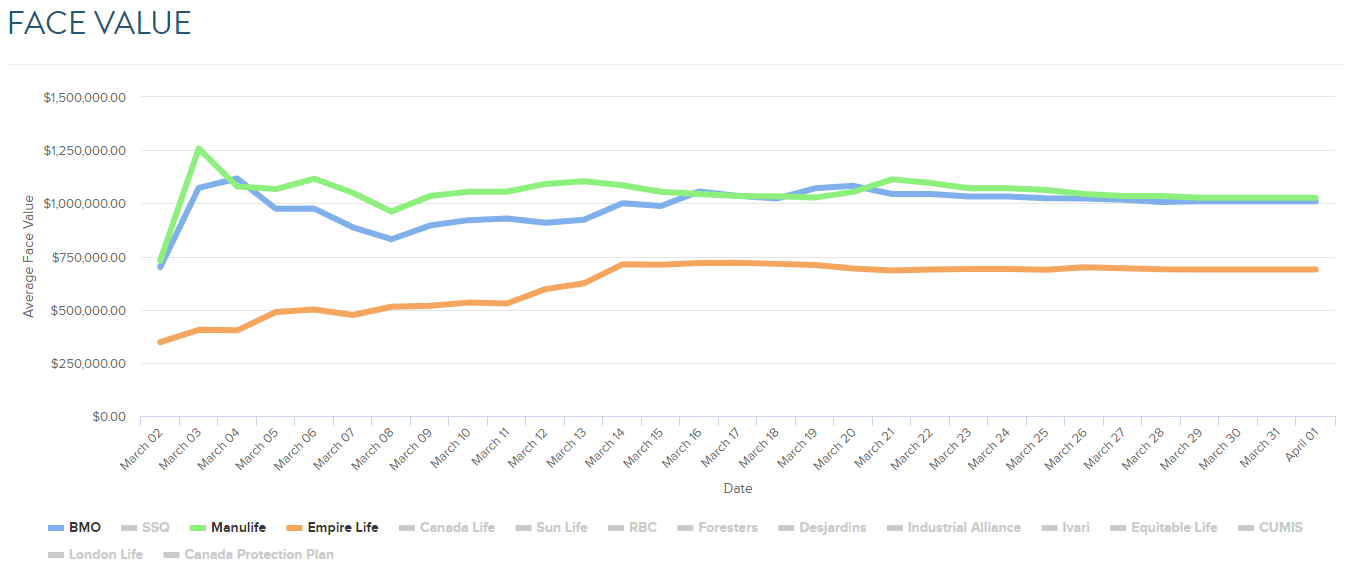

In March, Empire Life was the most selected term product by a fairly significant margin. Second place goes to Manulife with BMO rounding out third. This is an interesting juxtaposition in the sense that the Empire life product is essentially a stepped T100. We analyzed this product on our April Webinar and discussed how this feature almost operates as a safety net giving the client option for permanent insurance in the event they don't get an offer on the renewal of the initial term length. On the other hand, the Manulife product (even the Empire T30) have gone to a YRT renewal schedule. This is important because if a lot of this is being sold today, it's going to need to be reviewed in the future. YRT Policies are extremely difficult to review particularly if you do not save the renewal schedule so remember to "Mark Policy as Sold" in LDA so you save this schedule for a future review.

In terms of face value, we see Manulife leading with a close second being BMO and Empire taking the third position. In terms of overall face value leader for the month, Sun Life take top face value honours.

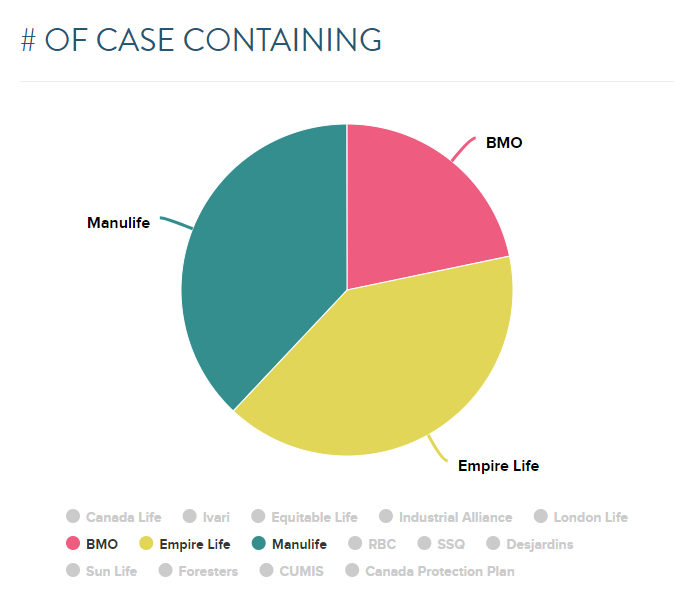

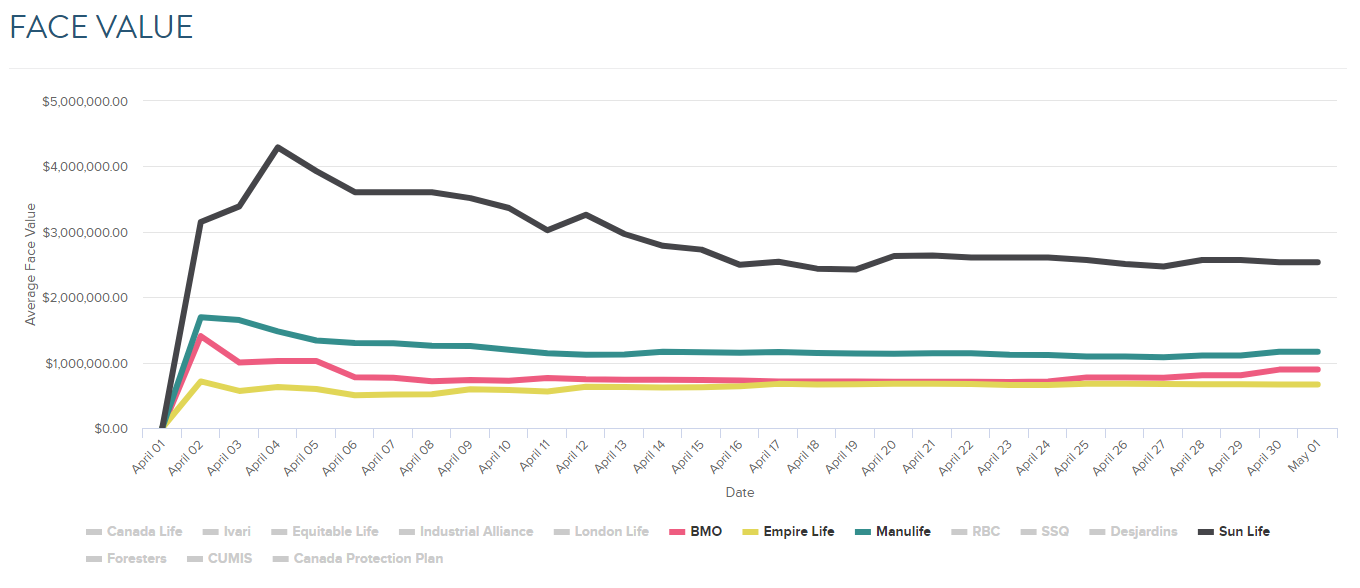

April

In April, our ranking stayed the same with Empire in first Manulife in second and BMO in the third position. However, the gap between the top position was much tighter this may be in part to Manulife making vitality available on more product lines.

Face value also stayed relatively stable for the top three with empire picking up ground on BMO. Top Face value for the month remained Sun Life.

May

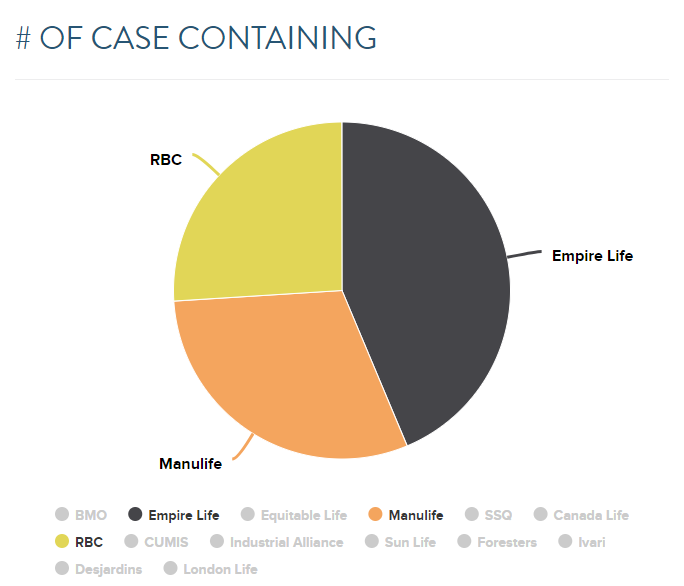

May saw similar results. However, RBC edged BMO for a place on the podium taking the third position, Manulife placed in the penultimate spot with Empire Life holding a commanding lead.

Face value leader was Sun Life however of the top three companies volume wise Manulife was the winner with the best combo of volume and face value.

Universal Life

Looking at the cases created, we can see that UL still has a place in the Canadian landscape. However, it has certainly fallen out of vogue. Universal Life is presented roughly 1 time for every 5 times that whole life is, not exactly a surprise given the investment and interest environment of the past few years.

March

In Terms of top companies in the Universal life space, Manulife took top honors for March, followed by Canada Life in second and BMO Life in third.

A look at face value shows Canada Life with the best balance but a trend of Sun Life taking top honours in terms of sheer face value. Kudos to them for large case appeal.

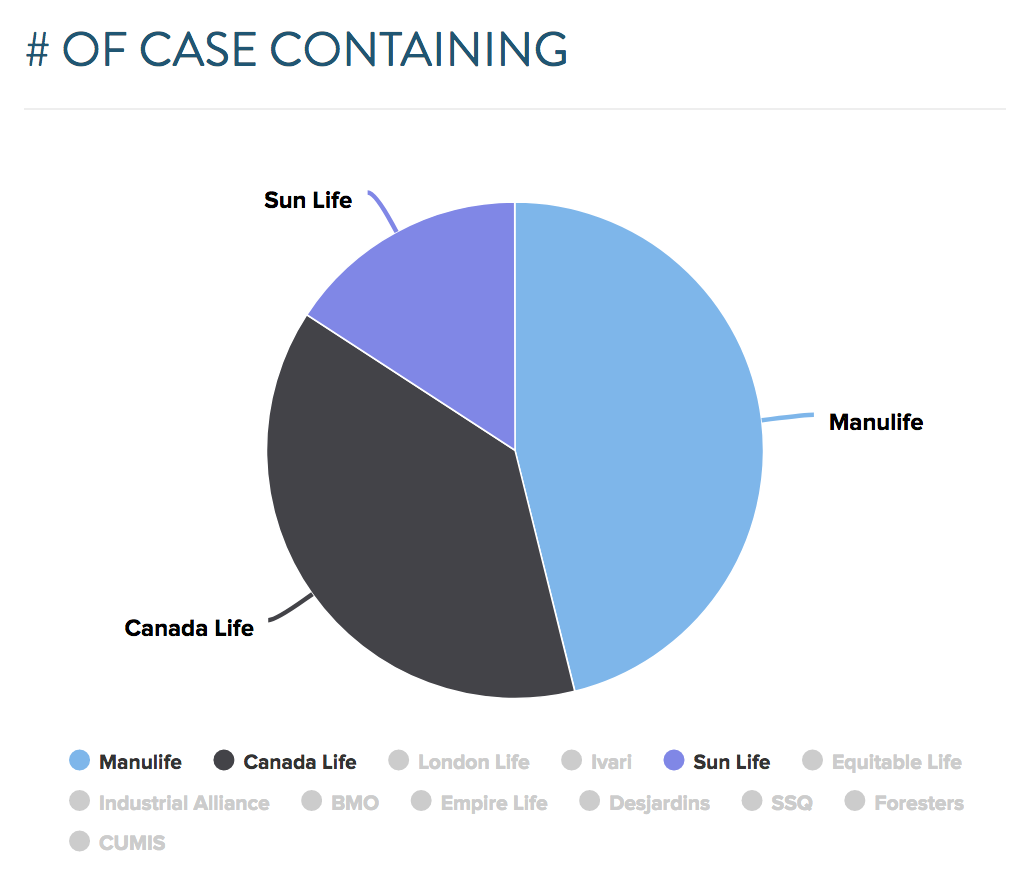

April

April has Sun Life gaining traction in the market knocking BMO from the podium. However, Manulife still represents the lions share of the market with Canada Life increasing its volume from the previous month however still in the middle.

Equitable took top face honours in April thanks to a great start. They were followed by Sun, Canada and Manulife.

May

BMO stormed back onto the podium knocking Canada Life from the top three and marginally leapfrogging Sun. Manulife maintained its dominance in this category. A quick look at a the rankings shows this market is dominated by price with these companies consistantly ranking near the top of the survey. A good combo with reputation and competitive product. We will keep an eye out to see how this product line trends going forward

Face Value saw Canada Life perform higher than average at the start of the month with Sun Taking the home the bacon by the time the month was over.

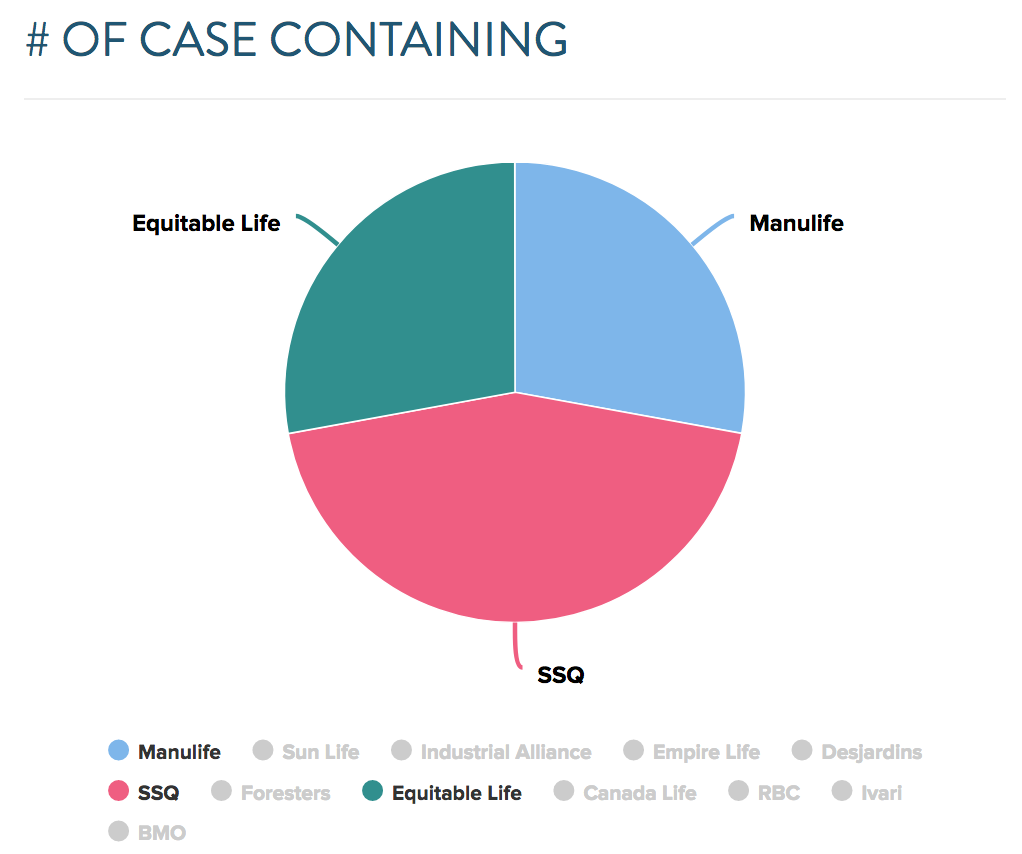

Critical Illness

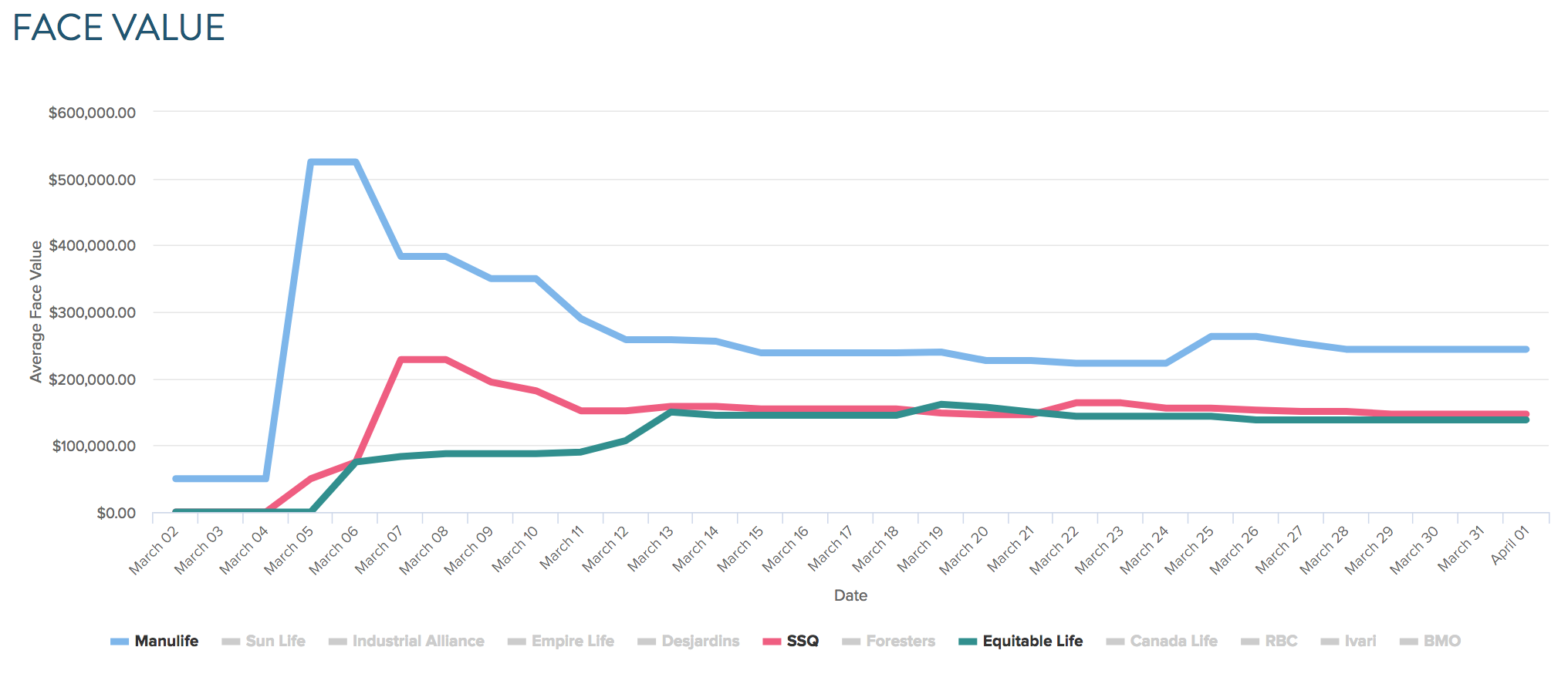

March

Critical Illness brings all new players to the table. SSQ dominates the case count putting Manulife and Eqitbale neck and neck for runner up. This is not shocking as SSQ has by all accounts an excellent product with extremely competitive pricing and a wide selection of range.

In terms of face value, Manulife was the leader of the bunch but SSQ and Equitable are right on their heels.

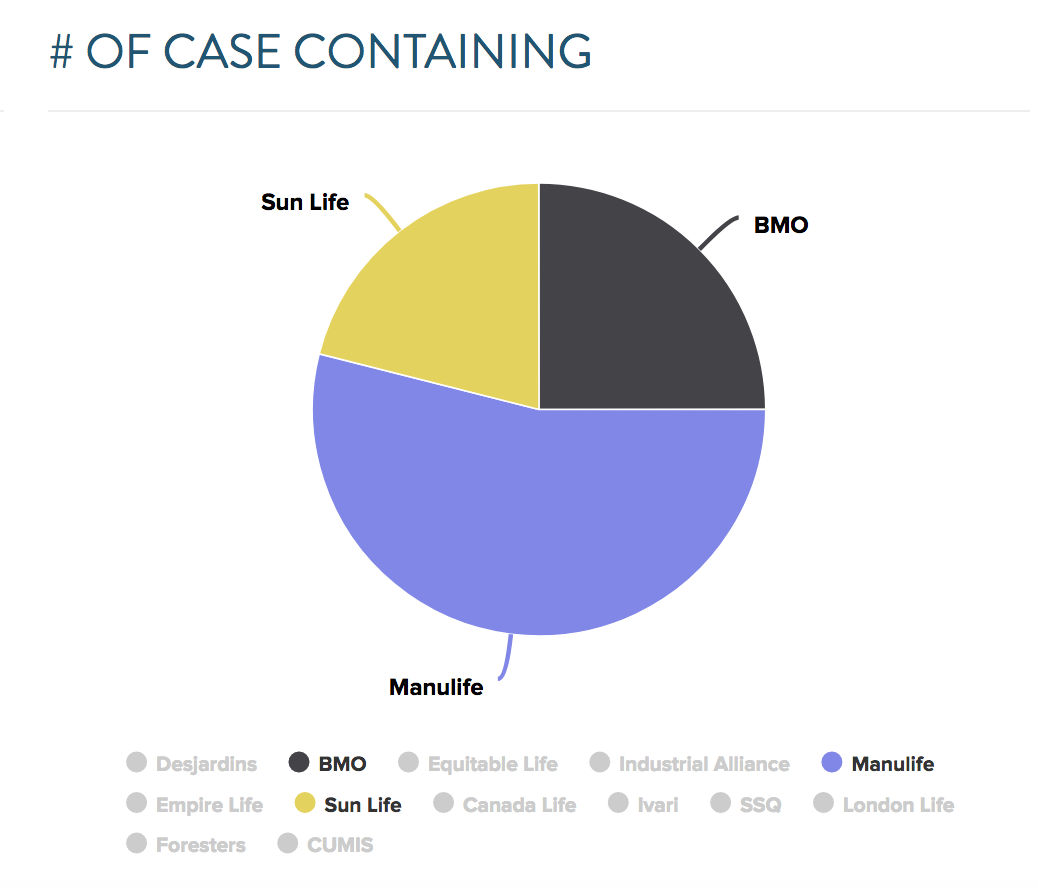

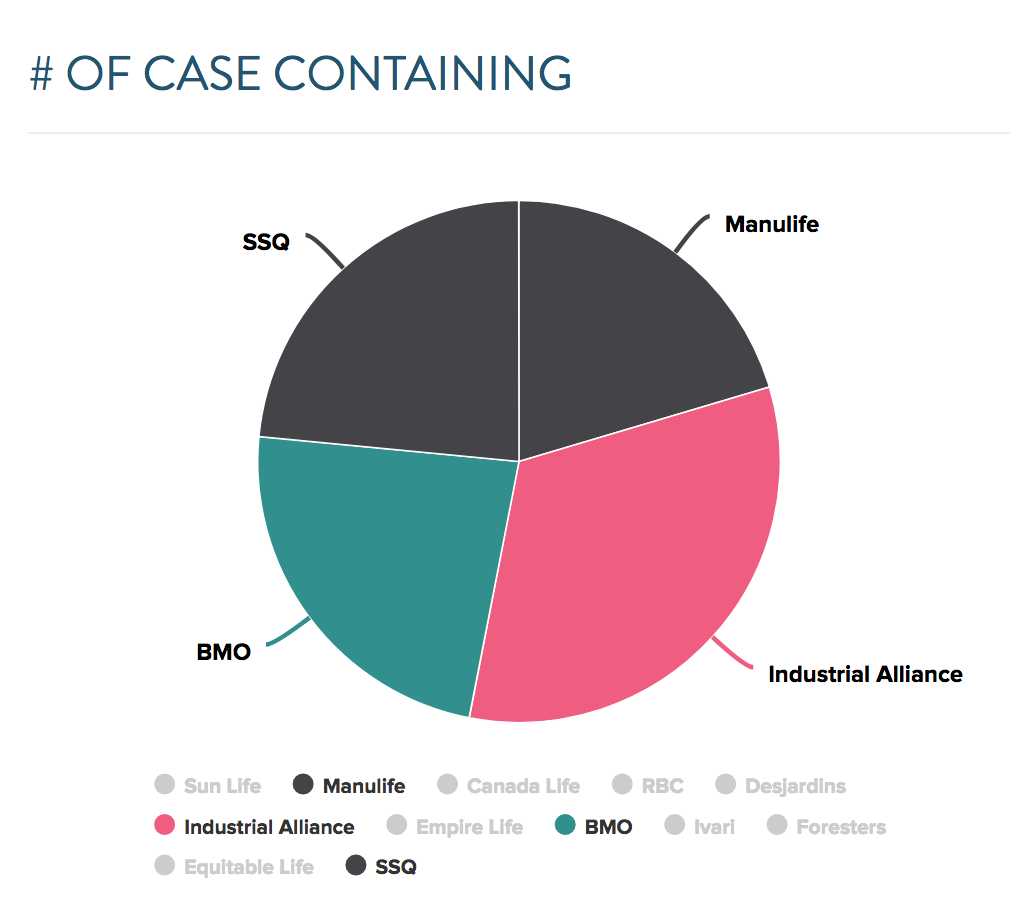

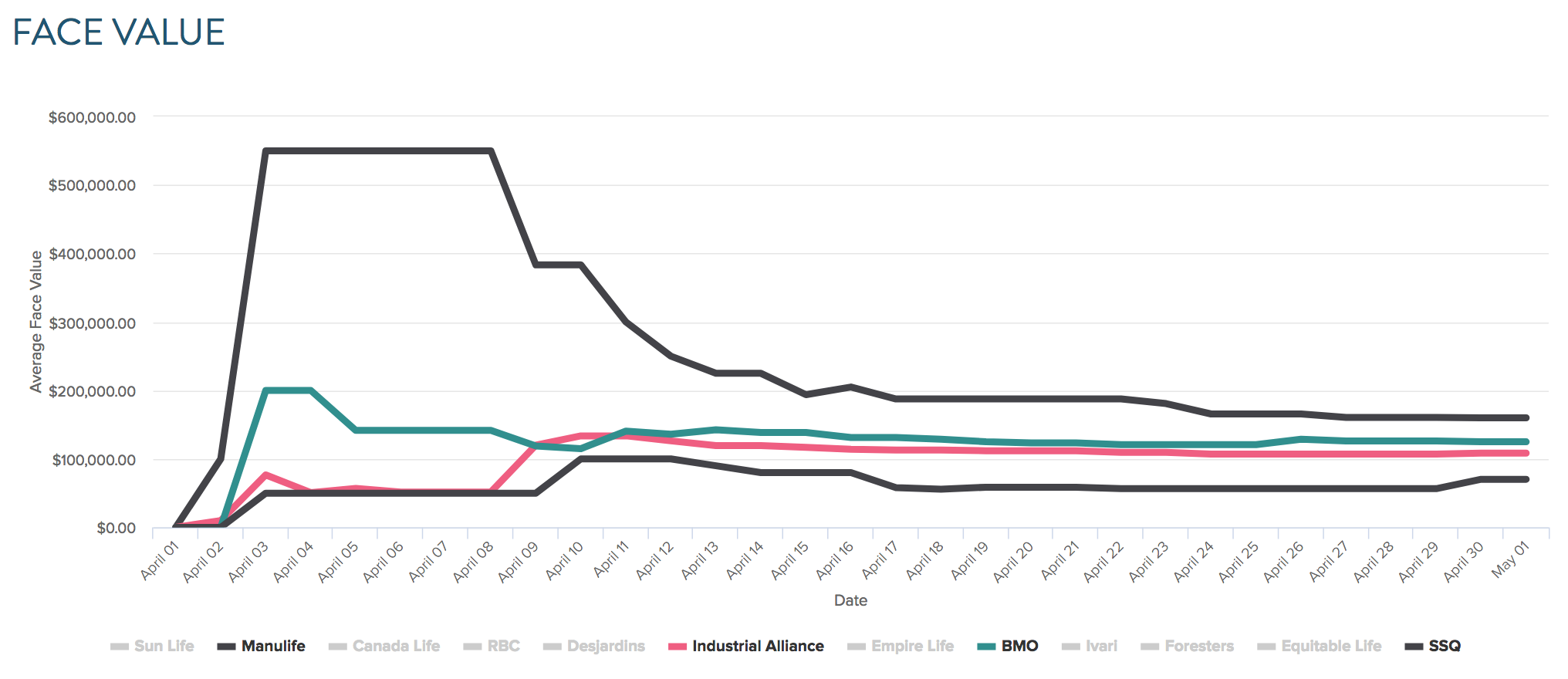

April

In April, Industrial Alliance shot up the rankings taking pole position from SSQ. However, SSQ and BMO had a great month in a tie for sevcond and Manulife in forth.

Manulife took down the top face value due to a strong start to the month. BMO and IA were neck and neck and nearly caught up by the end of the month.

May

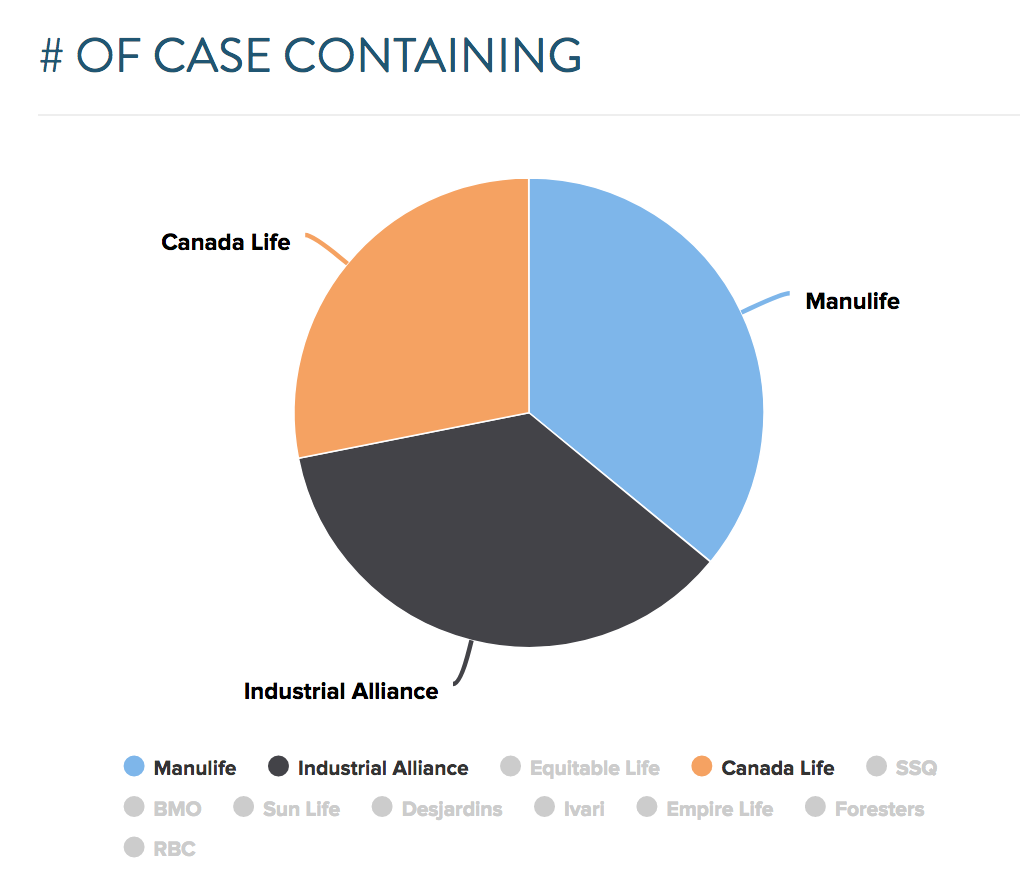

May continued to see new players gain steam. Canada Life, Manulife and IA Make the podium with IA taking the pole; however, it was a close heat.

Industrial Alliance was our face value champ and the face and case count leader (a good combo) In terms of case count, we could still see more cases presenting including or focusing on CI so we'll make sure we include it in our webinar serries to refresh how to present it.

Criticall illness is often an afterthought to Life Insurance. However, it certainly makes a great cross-sell and compliment for your clients. If you want some strategies to get more CI in front of your clients Read our article

Conclusion

Wrapping up, I am excited to see how the coming months shape up in terms of momentum and market share with new products hitting the shelf. Let us know your thoughts and get in touch if you have questions about the uses of analytics for your business.